Investing in Real Estate Development

-

Thinking About Condo Development in Washington? Read This First

Here’s the thing nobody tells you about forming a condominium in Washington State—it’s a freaking pain in the ass. Sure, many zones now allow up to two ADUs (Accessory Dwelling Units), and developers are jumping on the trend of setting them up as separate condos for sale. Some are even combining adjacent properties to maximize…

-

Teen Parenting and Real Estate Ventures

Eugene immigrated to the US in 1996 from Russia. He has three kids, two teenage daughters and a young son, All 4 years apart. Eugene does JVs with Owners of land in Western Washington. The episode had a lot of context around the parenting of teen daughters and to both provide privacy for their actions/texting…

-

Best Practices for Global Real Estate Modeling

In this episode of the Real Estate Runway Podcast, Chad welcomes Eugene Gershman from GIS Companies to talk about unique real estate development strategies focusing on multi-family residential projects. Eugene shares insights on partnering with property owners to leverage their land for profitable developments, emphasizing the benefits of expert guidance and streamlined processes. The episode…

-

Fundraising and Development Strategies

Join us on this episode of The Fully Funded Show as we dive into the world of real estate development with Eugene Gershman. From his beginnings in a family business to revolutionizing the industry, Eugene shares his journey, insights, and strategies for success. Whether you’re an aspiring developer or a seasoned pro, this episode is…

-

The goal is to double the investment. How is it possible?

I made a simple illustration using a single-family development project. Consider a single-family home, constructed in the 1950s and nestled in a high-demand neighborhood. There are plenty of those around Bellevue, WA. Such properties are often prime candidates for redevelopment. In the past, infill builders would be snatching these homes, offering all-cash deals with quick…

-

Navigating Air Rights: Lessons from a Deck Dispute

“Your deck is going to be hanging over my property!” That was the exclamation from a neighbor upon reviewing our plans for a new custom project. This unexpected claim led us down a path of discovery and resolution that I believe holds valuable lessons for any real estate developer. Initially, we were baffled. Had we…

-

Podcast: Strategic Partnerships for Growth

I had a fun interview with ROIClear the other day. Please check it out and subscribe. Eugene Gershman of GIS Companies visited with ROIClear Podcast for an insightful conversation with Ray Hightower about real estate development. Eugene explained how GIS’s partnership model allows them to make an impact on reducing the housing shortage. The time…

-

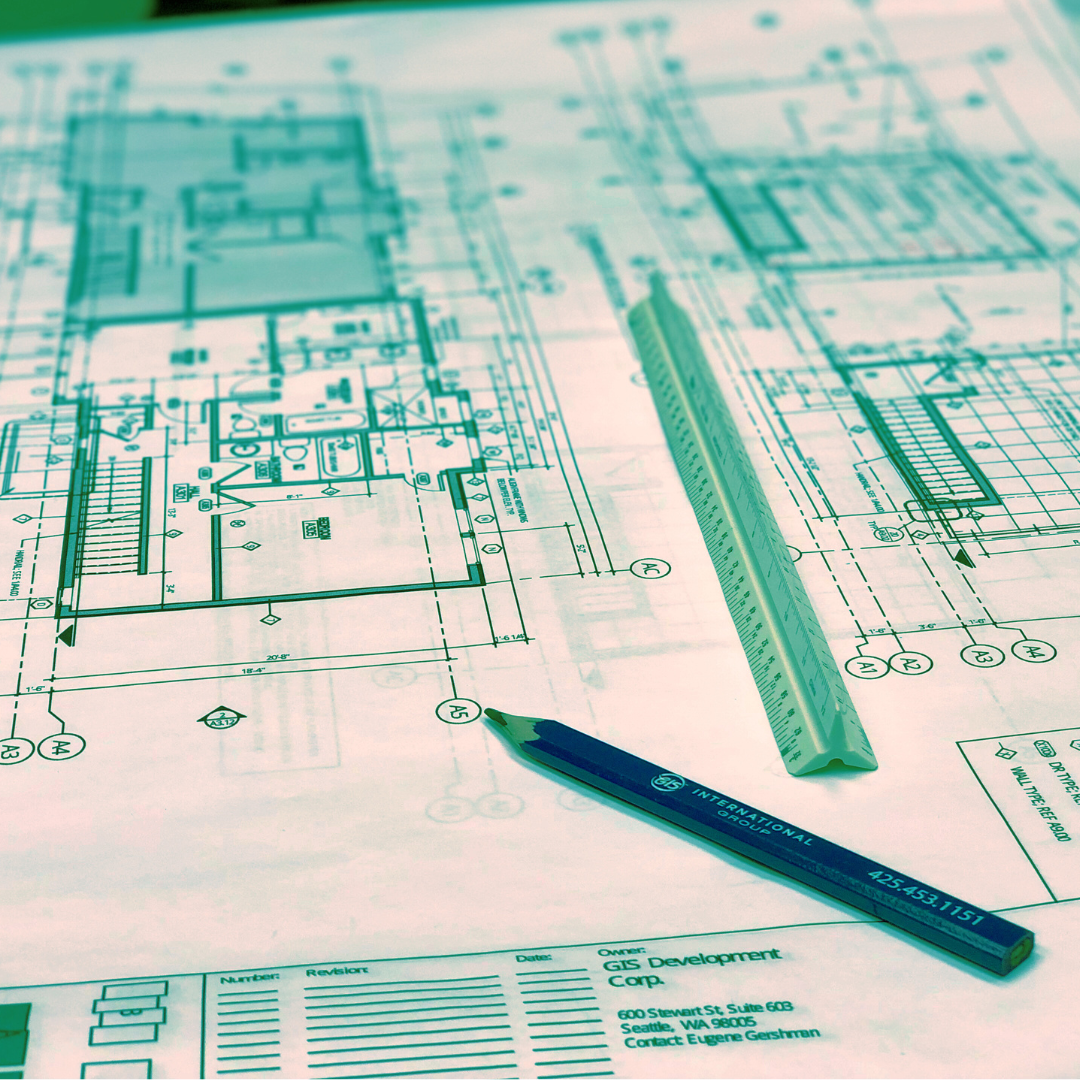

Do these five things first before paying anyone to do a feasibility study.

1. Land use code or zoning research. There is nothing fancy here; simply flip through the zoning maps and code to understand basic restrictions like height limit, bulk, setbacks, parking requirements, etc. Most municipalities have that data online. If the site is zoned industrial, you may not be able to build apartments or the other…

-

Podcast: Unlocking Property Potential

I had a fun conversation with Steven Arita about real estate development partnerships. We talked about how we partner with property owners to bring their projects to reality. In the high-interest rate environment and depressed real estate sales, now is the perfect time to begin the design and permitting. By the time the project is…

-

Podcast: Eugene Gershman’s Entrepreneurial Journey in Real Estate…

Eugene Gershman said: I don’t like talking much about where I am from originally. I’m not embarrassed, but I have always felt self-conscious about it. First, it was my accent. Now, the politics. I always tried to steer the conversation away from it. I really enjoyed this interview and the conversation we had, but after…

-

Top Five Reasons to Invest in Real Estate Development: An Ex-Financial Consultant’s Take.

Some of you might know that I used to be a registered representative by FINRA (when it was still called NASD) at the beginning of my career. The first question we would always ask, and most cover-you-butt forms would re-state, was: “What is your investment objective?” Most experienced investors know the three main investment objectives:…

-

Development Outline

One of the frequently asked questions we receive at GIS is how we collaborate with property owners (sometimes referred to as principal sponsors or sponsors) on new developments. There are various possible structures for such partnerships. Before a deal structure is even discussed, we need to study the project and believe that it makes sense. …

-

Do Not Sell Your Land!

If you own a piece of land that has potential for development, you might be tempted (or pressured by a spouse, relative, neighbor, financial advisor, or realtor) to sell it. But before you do that, consider this: you could be missing out on a huge opportunity to increase the value of your property and create…

-

The Dark Side of Discounts: One Side Has to Lose.

How can people feel good about buying something with a deep discount when they know the seller might lose everything in that transaction? I recently read an article about a developer who took his own life while facing financial challenges. He was about my age with a similar background. I did not know him, but…

-

How To Double Your Investment?

Recap: – Financing projects of less experienced developers is like investing in startups with more predictable outcome; – Real estate projects typically target 2x returns compared to 11.8% average return of S&P 500 over the years; – GIS Companies has put together a structure to reward investors and mitigate their risks; Full post to follow……………………………….. I’ll define…